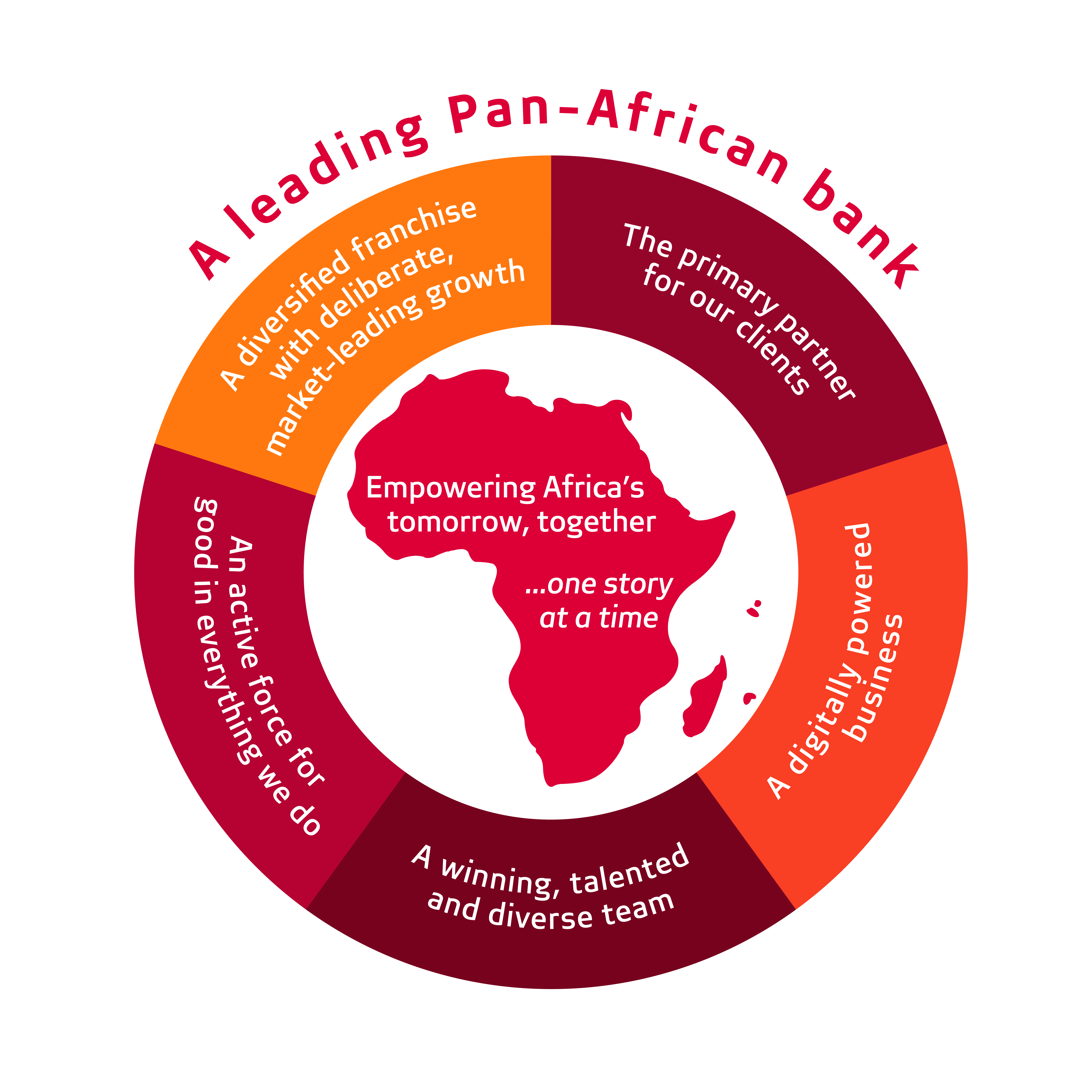

Our strategy

As a bank, we are now looking to the future to raise our performance to new levels, and truly outperform the market. Doing so requires us to bring together the power of business performance and organisational health driven by a robust Group Strategy.

Our Group Strategy is anchored around five core pillars:

A diversified franchise with deliberate, market-leading growth: We will be purposeful regarding where we compete, identifying attractive growth pockets by geography, segment, and product. We will allocate our capital sustainably and manage risk appropriately

The primary partner for our clients: We aim to be the primary partner for our clients by truly understanding and satisfying their day-to-day needs, creating and delivering value across the entire client relationship, and building a brand our people and clients can be proud of

A digitally powered business: We aim to be a digitally powered business – delivering a superior digital experience, using data as a strategic asset, continuously evolving our technology architecture, and improving trust and security while operating as a nimble organisation

An active force for good in everything we do: We will be an active force for good by managing climate-change and biodiversity risks and opportunities, contributing meaningfully to the societies in which we operate, maintaining the highest standards of governance

A winning, talented and diverse team: We will build a winning team by developing a competitive advantage through our culture, attracting and retaining Africa’s leading talent, organising distributed leadership around our clients and supporting and enabling our people

An active force for good in everything we do

We want to drive measurable, material change in our communities in a way that brings our purpose to life, differentiates us and strengthens our business. To do this, we have identified three specific ESG focus areas where we will invest to deliver a truly ambitious agenda: financial inclusion, diversity and inclusion, and climate. We selected these areas by considering the importance of the different ESG topics for our stakeholders, the potential impact on our business, and our strengths and assets. We will continue to deliver on our broader ESG agenda in line with our robust risk management processes.

We have selected strategic focus areas with actions to accelerate our journey with purpose:

Financial inclusion

As a universal bank, we are uniquely positioned to make a substantive difference in extending financial inclusion to underserved groups and desire to make inter-generational wealth creation accessible to all. We have been active in this space, with examples including the expansion of our affordable housing mortgage portfolio enabled through an International Finance Corporation’s (IFC) loan, our Sernick Developing Farmers programme, and our inclusive, entry-level banking propositions. We aim to scale our efforts going forward.

Making inter-generational wealth creation accessible to all:

- Equitable access for underbanked communities – both individuals and SMEs, and with a particular focus on youth and women

- Ability to meet the full set of financial needs across transactional banking, credit, insurance, and wealth accumulation

- Products and services that are affordable and responsibly delivered.

Diversity and inclusion

Internal and external stakeholders cite diversity and inclusion as critical topics and enablers in unleashing our talent and delivering outperformance. We aspire to enable all our people to bring their true selves to work and aim to be a beacon of inclusion across the continent. We have set clear targets for transformation and diversity and want to address inclusion more explicitly.

Enabling all our people to bring their true selves to work, and be a beacon of inclusion externally across the continent. This means not only unleashing our talent internally to outperform, but also supporting and enabling diversity and inclusion with our suppliers, clients, and communities we operate in:

- Disadvantaged demographics (gender, ethnicity, age, sexual orientation, disabilities etc.) are fairly represented at each level of the organisation

- High share of employees that perceive they are accepted members of the workforce. Perceptions are not skewed to specific demographics.

Climate

It is critical to investors, regulators and other stakeholders that the irreversible impact of climate change risk is incorporated into decision-making and planning, and that compelling business opportunities, such as green product offerings, be incorporated into our core business.

Our climate strategy has four components: financed emissions targets; green business opportunities; climate risk processes and governance; and external engagement. We have set our net-zero ambition in line with our goal of becoming Africa’s leader in sustainable finance.

Reaching net zero by 2050 and becoming Africa’s leader in sustainable finance:

- Raise the bar on external engagement on our ambition and progress

- Develop sector-specific pathways with a thorough analysis of the trade-offs involved.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)