We’re committed to continually driving positive societal change by investing in women.

As a purpose-driven organisation, we’re committed to being an active force for good in everything that we do. Empowering women is one area where we have focused our efforts. We believe that empowering women is not just an economic imperative, but also a vital social cause that deserves our wholehearted support. To that end, we have implemented a deliberate approach to advancing women within our organisation.

- We’re proud of our consistent prioritisation of women’s advancement through appointments and promotions.

- Our Women Manifesto reflects our commitment to gender inclusivity and providing equal opportunities for women throughout their careers. By empowering women within our organisation, we create an environment where they can thrive and succeed.

- Our IgniteHer Women’s Development Programme won gold in the Best Advancement in Leadership Development for Women category at the 2022 Brandon Hall Group Human Capital Management Excellence Awards.

- We were recognised by Forbes as one of the World’s Top Female-friendly Companies for 2022. We ranked among the top 40 companies worldwide in championing gender equality and creating an inclusive work environment.

- In addition to our internal initiatives, we provide substantial funding to women-owned businesses through our lending practices. We understand the significant role women play in our communities and the importance of enabling their economic and social empowerment. In 2022, we allocated over R6.9 billion to support women-owned businesses, helping to accelerate their progress and success.

- We won the Sustainability and Social Investment Awards 2022 for the best company promoting STEM education, together with two additional awards, of which one was for our women empowerment drive.

- We entered a five-year partnership with the Mastercard Foundation in Ghana to create the Absa Young Africa Works, aimed at enabling young people, particularly young women, to access work in investing in SMMEs.

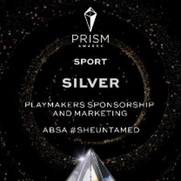

- In the sport of mountain biking, we are committed to growing the #SheUntamed initiative, a programme designed to improve women’s access to this sport through increased participation of women in the Team Absa line-up.

- We’ve also worked with the United Nations Women to fast-track the implementation of the presidential pronouncement to increase access to public procurement for women-owned businesses and women from designated groups to a minimum of 40%. Women-owned enterprises involved realised a 166% increase in revenue, from R2.1 million to R5.5 million. This also led to growth in jobs created, from 58 to 121.

We firmly believe that empowering women is not only the right thing to do, but it also drives positive change in society. We remain committed to advancing gender equality, both internally and externally, and will continue to champion the empowerment of women in every aspect of our work.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)