Absa Results

Absa Group 2025 Interim Results

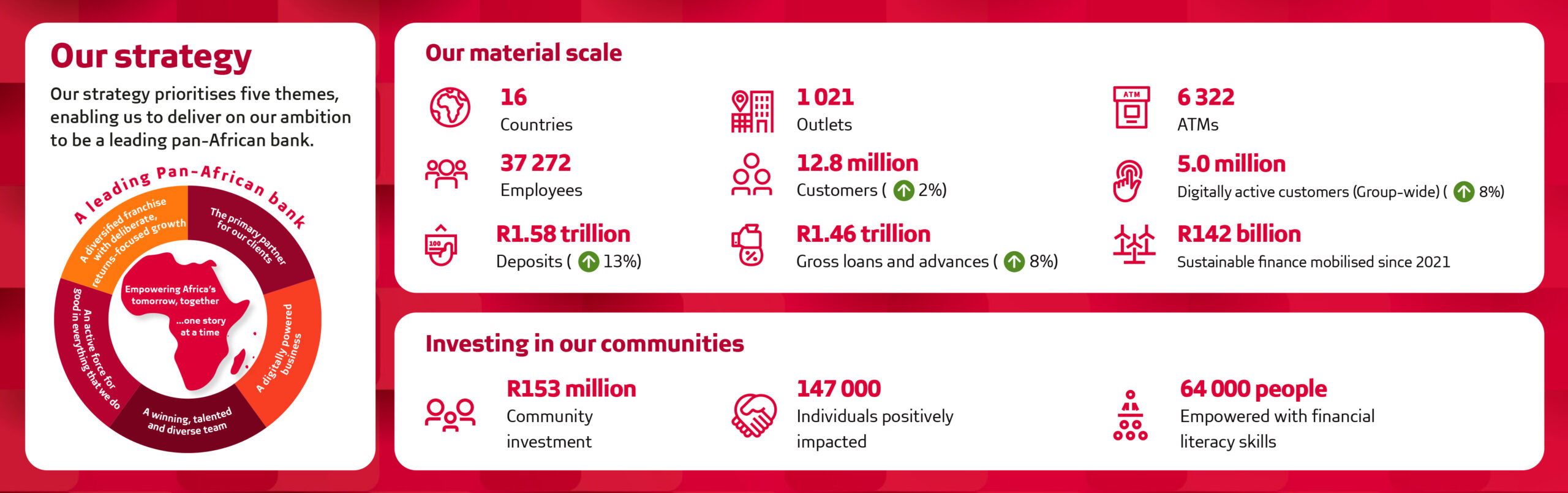

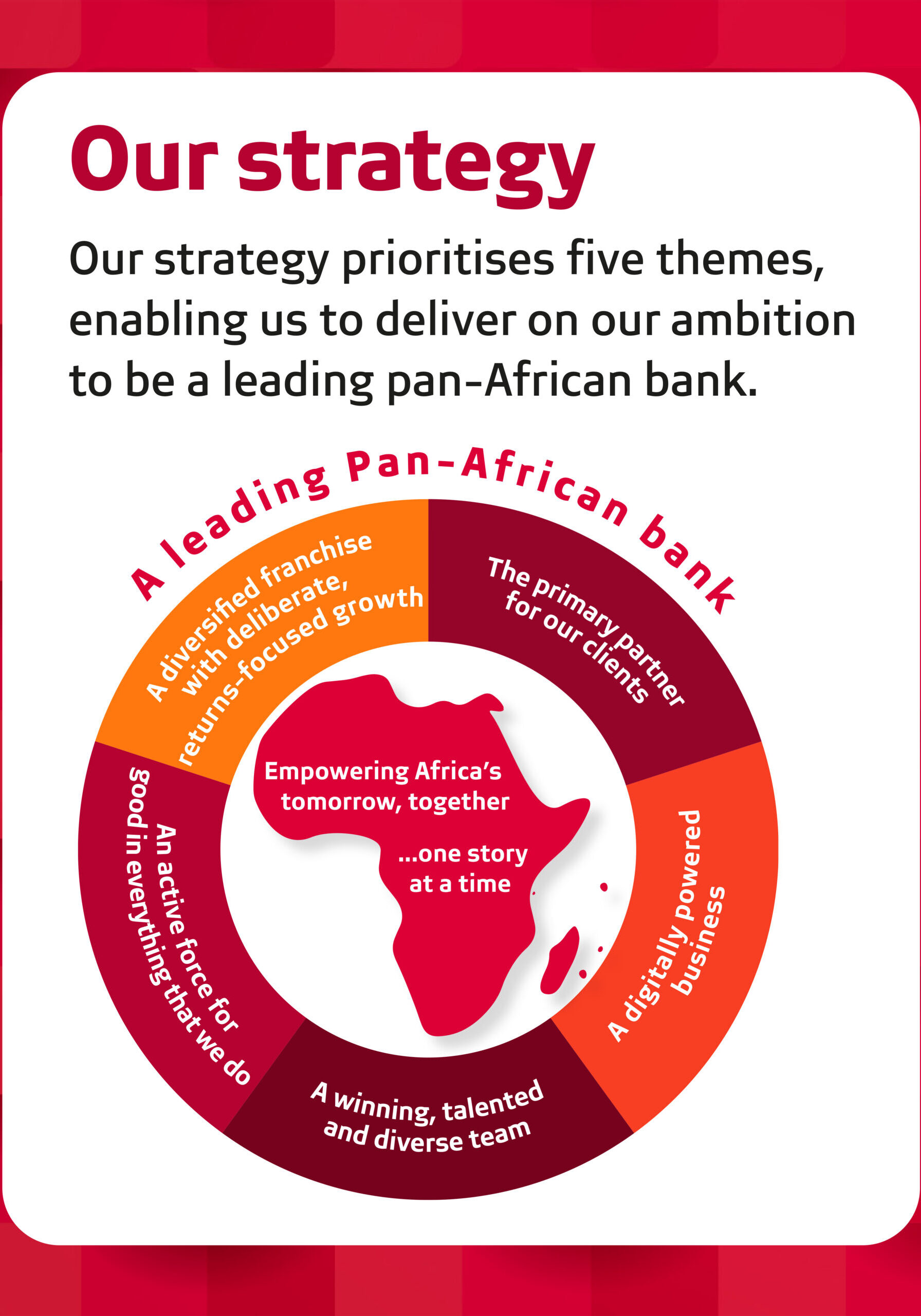

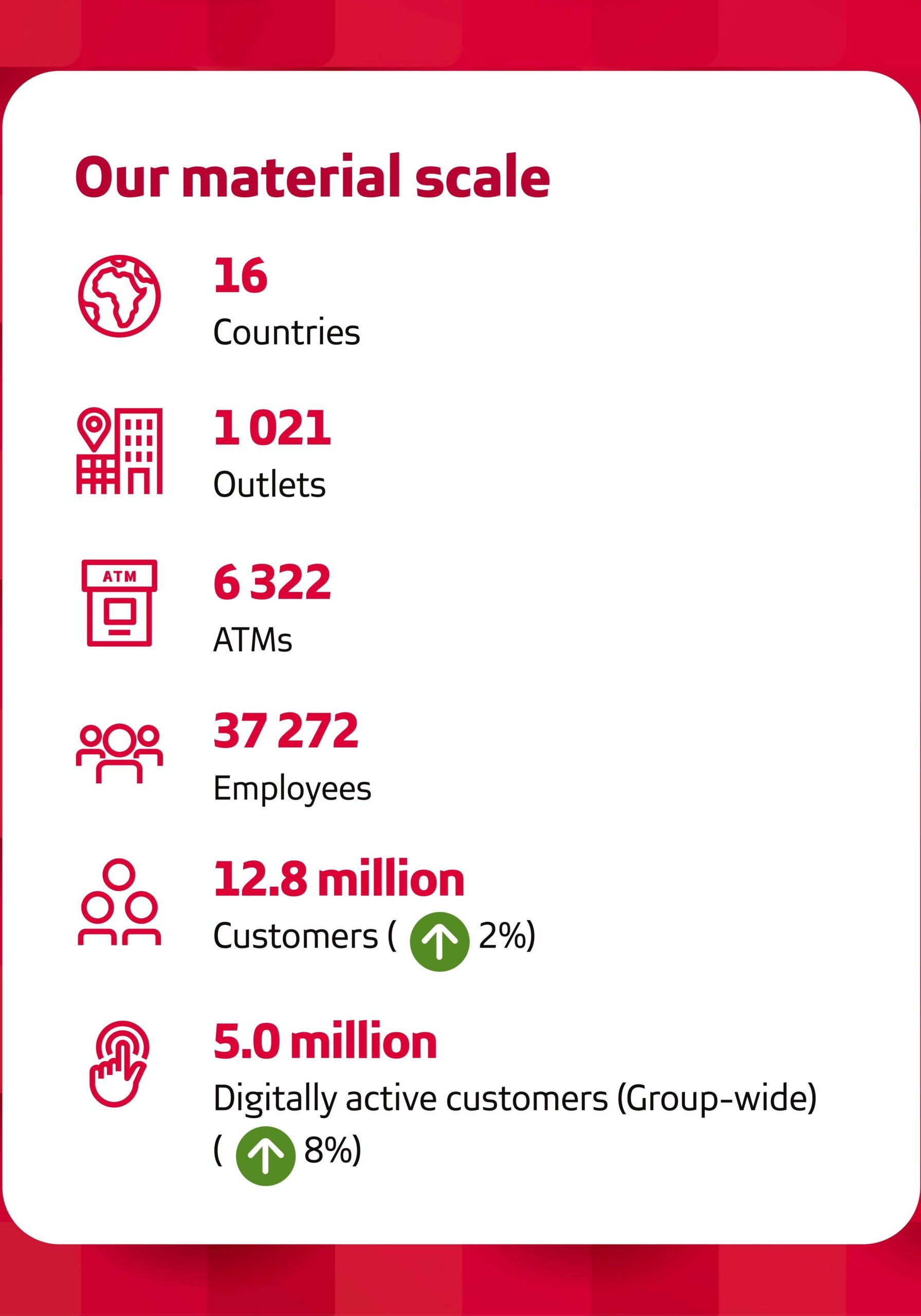

Absa Group has delivered material earnings growth for the 2025 interim period, despite global economic uncertainty and shifting market dynamics. Our 2025 interim performance reflects our continued commitment to delivering meaningful value to all our stakeholders, as we work hand in hand to empower Africa’s tomorrow, together… one story at a time.

Absa Results

Absa Group 2025 Interim Results

Absa Group has delivered material earnings growth for the 2025 interim period, despite global economic uncertainty and shifting market dynamics. Our 2025 interim performance reflects our continued commitment to delivering meaningful value to all our stakeholders, as we work hand in hand to empower Africa’s tomorrow, together… one story at a time.

Group CEO Remarks

Group Key Figures

Revenue

R 56.5 bn

Impairments

R 7.2 bn

CLR decreased from 123 bps to 100 bps

Operating costs

R 30.0 bn

Headline earnings

R 11.9 bn

Cost-to-income ratio

53.2%

Return on equity

14.8 %

Pre-provision profit

R 26.4 bn

Group CET 1 Ratio

12.5 %

Business Unit Headline Earnings

Personal and Private Banking (PPB)

R 3.2 bn

Business Banking (BB)

R 1.7 bn

Absa Regional Operations Retail and Business Banking (ARO RBB)

R 1.1 bn

Corporate and Investment Banking (CIB)

R 6.4 bn

Head office, Treasury and other operations

R 0.5 bn loss

Strategic Update

Message from FD

“While we continue to operate in a highly competitive environment, we remain focused on identifying opportunities to grow our balance sheet, our customer base and maintain our competitive positioning across our markets.”

Deon Raju

Absa Group

Financial Director

Media Release

Absa Group Delivered 17% Headline Earnings Growth Driven by Lower Impairments and Pre-Provision Profit Growth

Absa Group delivered strong earnings growth for the first half of 2025, reflecting successful execution of its strategic priorities. Headline earnings increased 17% as credit impairments declined and pre-provision profit grew.

Revenue increased, underpinned by strong non-interest income growth and stable net interest income, reflecting solid divisional revenue contributions. From a geographic perspective, double-digit earnings growth was delivered by the Group’s South African operations, mainly due to lower impairments, while Africa regions’ performance was mainly driven by strong pre-provision profit growth as underpinned by strong customer growth.

Our highlights in 2025

Our highlights in 2025

Looking back at the first half of 2025, we see more than numbers. We see people, and purpose in progress. Over 37 000 Absa colleagues across countries building something bigger than banking. Backing businesses. Strengthening communities. Helping shape a stronger, more inclusive Africa.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)