Budgeting

We can’t tell you that creating a budget is fun, but if you want to proudly say, “I grew it”, it is one of the most essential tools in your savings arsenal. A budget helps track income and expenses, giving you a clear picture of your spending habits, enabling better financial planning and decision-making. Think of it as “a way for you to tell your money where to go instead of wondering where it went.”

A budget puts you back in control, allowing you to decide how you spend your money and how much to put towards your savings goals. As the saying goes, “seeing is believing”. You’ll be surprised by what you see once you have a budget in place.

In this guide, we will help you create your own budget. By understanding your spending habits, you can make informed decisions and become a smart spender who saves too.

Wants and Needs

When budgeting, distinguish between wants and needs. Needs are essentials like food and housing, while wants are things you’d like but can live without, like new sneakers. Identifying these helps you find savings opportunities. Download the table below to list your own wants and needs.

What comes in and where does it go?

To fully understand where your money goes, it’s essential to keep track of all your expenditures, not just the big ones but the small ones too. While this requires discipline and time, the results will be worth it. To get a thorough understanding of your spending habits, you should do this for at least three months. Follow the steps below and fill in the information in the table provided.

Once you’ve done this, you’ll know exactly where you are overspending and where you can save. At this point, you can start tweaking your expenditures to align with your financial goals.

Some Tricks to Manage your budget

A budget is the first step to writing your own financial success story. If this is your first time doing this exercise, it can feel a little overwhelming. That’s ok. Everyone feels this way. To help you manage your budget and give you more control over what money you’re spending where, we thought we’d give you a few tricks. Take a look through these and find the one that suits you best.

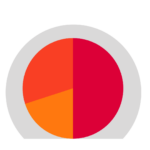

This is a simple but effective guideline for managing personal finances. It helps you divide your salary into 3 categories: needs, wants and savings.

Using cash envelopes for categories like entertainment and hobbies can help you avoid overspending and stay aware of your spending. Withdraw the budgeted amount for each category, and when an envelope is empty, stop spending in that area.

This Japanese method, meaning "Household Financial Ledger," promotes mindful spending by tracking all income and expenses by hand. Use one notebook to plan monthly income and expenses, and another to record daily spending. At month’s end, compare both to become more aware and intentional with your spending.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)